Business as Unusual: Financial Crisis, Computing and Money Machines

Business as Unusual: Financial Crisis, Computing and Money Machines

in/compatible systems

Panel with Orit Halpern (us), Georgios Papadopoulos (gr), Stefan Heidenreich (de) and Ralph Heidenreich (de)

Moderated by Christopher Salter (ca/de)

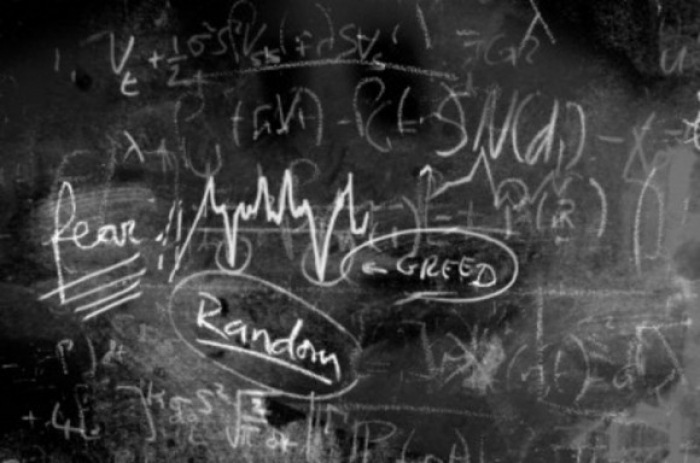

The Euro is crashing. US Debt is spiraling. Banking is in crisis but luxury goods sales are up! The global finance system is out of control, the public agora replaced by the 24/7 calculations of machines, the weakened nation state buckling under the incessant flows of virtual capital. In this age of turbulent finance, what effects do the new media have in creating new entangled systems of monsters and mutants going by the names of quants, Ponzi schemes, derivatives and “too big to fail” bailouts? With experts from the areas of economics, philosophy, new media studies and the history of science, the panel Business as Unusual zeroes in on the contradictions, breakdowns and incompatibilities with systems of money and finance in our calamitous era of late capitalism.

Individual Presentation Descriptions

Stefan Heidenreich (de) & Ralph Heidenreich (de)

the money machine.

incompatibilities of money creation, trading schemes and network power

without computing and digital media, the financial sphere could never have become the monster it is. The effects of new media set in at three points. the creation of money is by itself a simple routine of book-keeping. but thanks to so-called financial innovations the banks extended it to a ponzi-scheme of enormous size.

there are estimates that computers and algorithms account for more than 50% of trading. reliable data are difficult to achieve, as conventional market places have diversified into high-frequency casinos and so called dark pools.

and last but not least, we witness in fornt of our eyes, how the smaller institution of the state surrenders itself to the bigger network of the banks. the transition of sovereignty is marked by the phrase "too big to fail" which applies to almost all globally active banks.

all these schemes amount to the core incompatibility of how to snythesize the virtual profits required to keep the money machine alive.

Georgios Papadopoulos (gr)

Money Deterritorialized

Money is no longer an instrument of national sovereignty. The global financial architecture has liberated circulation from geographical borders and made government control problematic. Crises become universal, but the same does not apply for growth, where voids, in/ compatibilities and blockages in the financial architecture maintain unequal exchange and unfairness in the global division of labour and wealth. How can we understand, criticize and debunk the control of money in this juncture?

Dr. Orit Halpern (us)

Paranoid Formations: Rationality and Crisis in Cybernetics

This paper historicizes our current discourses of “crisis” by examining how discourses of rationality and paranoia replaced those of crisis to define systemic failure in cybernetics and its related social, cognitive, and communication sciences.

While the immediate relationship between “crisis”, computation, and rationality might not be evident, a closer examination reveals otherwise. I demonstrate how, after the War, rationality came to be redefined in game theory and cybernetics as algorithmic, rule bound, and logically representable in a manner that had little to do with reason, consciousness, or autonomous choice, but everything to do with rethinking humans, machines, and systems in terms of communication, control, and information.

Counter, however, to our commonly held assumptions, rationality, even in game theory, was often defined as paranoid, dissociated from consciousness, and pathological. Early computer programs demonstrated that only the profiles of paranoid schizophrenics could be programmed, and cybernetically informed psychology studies found rational people the most likely to be brainwashed and become violent. Rationality, then, was a blessing and a curse—a technological opportunity and a self-destructive tactic. Could rationality be affective and logical, paranoid and reasonable, centralized and networked? All at the same time? Designers, social scientists, and engineers all recognized that the more successful you were at building a science of control and communication the greater the risk that systems would internally generate chaotic and self-destructive behavior. Reconciling these dialectics became a fantastical imperative for re-engineering everything from machines to minds; a technical mandate that has fundamentally changed what crisis is, and what the discourse can do.

(Image: confrontaal.org/PW)